There are plenty of Buy Now Pay Later (BNPL) apps available that you can choose from. But selecting the right one makes the whole difference between convenience and inconvenience.

That’s why we have gone through all the BNPL platforms and curated the top Best Buy Now Pay Later apps. It is created after going through their payment plans, credit limit and enrollment processes. So check out the list and select the right one which fits your requirements.

What is Buy Now Pay Later Apps?

Buy Now Pay Later or BNPL apps are great platforms that facilitate credit options with multiple flexible installment payment options with zero interest or sometimes a little interest rates.

During cash crunch or emergency, these BNPL apps come in handy to purchase your desirable products on preferred payment plans. The credit limit of these BNPL apps depend on your credit score and they improve as and when you make the successful payments later. Most of them offer no late fees structure but with higher interest rates albeit.

Now selecting the right BNPL is crucial to fit your financial requirements, since not all BNPL works the same way. You can choose BNPL apps based on what they offer and what they charge.

In case you have a bad credit score then you pick the one that doesn’t ask for credit scores, you can select based on the zero late fees or don’t have any hidden charges. That’s why to help you with this selection process, we have curated a list of top Best Buy Now Pay Later Apps for you to consider and pick below.

List of Best Buy Now Pay Later Apps –

1. Affirm

Top of the list is Affirm, a top-rated BNPL platform that lets you purchase everything you need online or in-store and make payments through it. The best part is no late fees or any other sort of hidden fees you need to pay. Along with flexible interest-free payments, you can find the ideal payment schedule for your needs.

Why Choose Affirm

- Offers online or in-store purchases.

- No late payment fees.

- Flexible payment schedule options.

- Supports all platforms and devices.

Interest rates - 0% to 30%

Payment terms - Make 4 interest free payments every 2 weeks or monthly installments.

Late fees - No late payment fees. 2. Afterpay

Afterpay is another popular choice for BNPL apps for its zero percent interest on credit options. It offers an easy one-payment option, 4 interest-free payments over six weeks with late payment fees included. You can use this option for both online and in-store purchases, supporting both mobile apps including android and iOS.

Why Choose Afterpay

- Zero percent interest on credit options.

- No hidden fees when payments are made on time.

- Good shopping collection online and in-store.

- Both Android and iOS mobile apps.

Interest rates - 0%

Payment terms - Pay in 4 interest free installments over six weeks

Late fees - Depending on the late payments : 8% to 25%3. Splitit

Splitit is the most flexible payments plan BNPL platform, which lets you choose the number of monthly payments according to your preference.

It doesn’t require a credit check to connect your credit card and there is no need to create a new account. There are no late fees or other hidden charges either.

Why Choose Splitit

- No credit check recruitment.

- You select the number of months payments.

- No late or hidden fees.

- Use your existing credit card.

Interest rates - 0%

Payment terms - Select any monthly payment plans

Late fees - No late or hidden fees. 4. Paypal Pay

PayPal is one of most popular platforms for digital payments across the globe, its PayPal Pay is also a highly accepted payment for both online and in-store purchases. It offers flexible payment options, you can choose between 4 payment installments per 2 weeks for zero interest or pick any monthly payment options also. You need not have to pay for any late or hidden fees on it either.

Why Choose Paypal Pay

- Widely accepted online and in-store.

- No late or hidden fees.

- Zero interest percentage credit option.

- Both iOS and Android apps.

Interest rates - 0%

Payment terms - Pay in 4 payments per 2 weeks or pay monthly for 6,12 or 24.

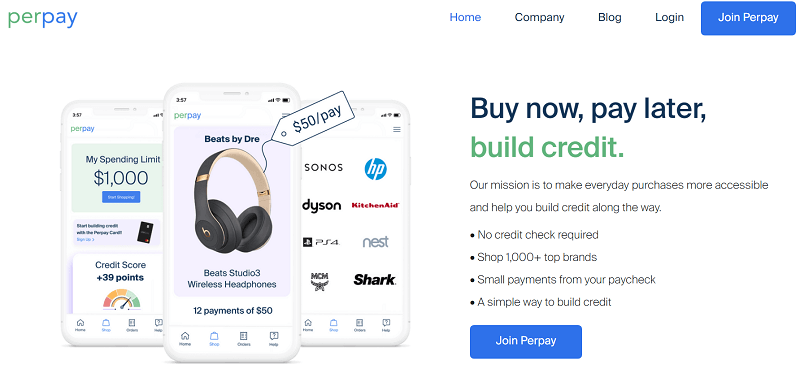

Late fees - No late fees. 5. Perpay

Perpay is ideal for people who do not have favorable credit scores, it doesn’t require any credit score checks. There are no late or hidden fees applicable, you can pick highly flexible payment plans according to your preferences. It helps you improve credit score as and when you purchase gradually.

Why Choose Perpay

- Helps improve credit scores.

- Credit checks are not required.

- Flexible small installment payments.

- Zero late or hidden fees.

Interest rates - 0%

Payment terms - Choose flexible installment plans depending on your pay schedule.

Late fees - No late or hidden fees.Frequently Asked Questions –

Q1. What is Buy Now Pay Later?

Buy Now Pay Later is a platform offering an instant credit option for zero interest period to shop online or in-store. The credit limit is determined on the credit score and improves as and when the payment plans are selected.

Q2. Which app is best for shop now and pay later?

The best BNPL app for shop now pay later is Affirm, with its easy payment options and no hidden fees. And also provides a wide array of shopping options both online and in-store.

Q3. What apps let you buy now, pay later?

There are many apps that let you buy now, pay later including Affirm, Afterpay, Pay in 4 Paypal and many more. Go through the above list provided and select the right one for you.

Q4. Does Amazon buy now, pay later?

Yes, Amazon does provide a buy now pay later option. Unfortunately, you can only use it to purchase on Amazon online websites or apps.

Final Words –

The immense advantage Buy Now Pay Later apps offer is hard to ignore especially when you need immediate money to purchase online or in-store. But don’t be fooled by all glitters of the instant credit, instead consider analyzing each individual BNPL platform before getting enrolled.

We have provided some of the best BNPL for you to consider above and choose according to your preferences.